- This event has passed.

Miriam Mitchell – Citizen Services Specialist, Service Canada Government of Canada.

Miriam Mitchell – Citizen Services Specialist, Service Canada Government of Canada.

Topics that Miriam will be covering include:

• Canada Pension Plan

• Old Age Security

• Guaranteed Income Supplement

• Canadian Dental Care Plan

Speaker details some benefits on offer from Service Canada

Miriam Mitchell, our guest speaker representing the Canadian Government in the department of Citizen Services Specialist, Service Canada, was introduced by Ralph Steffen.

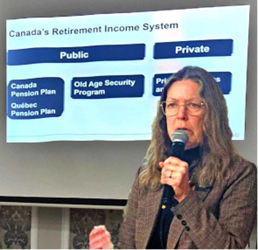

Miriam, a lifelong resident of Niagara, has been involved in many community activities including the Lincoln and Welland Regiment Band and has been a government worker for over 30 years. She pointed out that Service Canada has four offices including the Passport office at the Pen Centre. Miriam’s presentation focused on three category areas: Canada Pension Plan (CPP), Old Age Security (OAS), and the Dental Plan.

The Canada Pension Plan began in 1966 and is funded by employers, self-employed and mandatory employee payroll deductions and administrated by the Government. Application for CPP pensions can be made at age 60, 65 or 70. Higher payouts are available the later you apply for them up to age 70. Benefits depend on how much and how long you contributed. Miriam noted that if someone continues working, they must continue paying toward CPP until age 65.

She added that enhanced payouts may be available in certain situations such as for a disability or for assisted child care. She pointed out that CPP offers a survivor’s pension to a surviving spouse or common law partner.

The Old Age Security Plan is funded by our tax dollars and is available and paid out once Canadian citizens reach age 65 or can be delayed until age 70 for a higher payout The OAS is available to Canadians living in or out of Canada. This plan also includes the GIS supplements plan for low-income residents.

The Dental Plan came into effect in 2024 and is available to all Canadian citizens who have a family income of $90 thousand or less per year and the plan must be reviewed and renewed every year. There are a number of dental services that are covered by this plan provided the dentist is registered with the Government.

Miriam encouraged anyone wishing more information to go to the Government of Canada Website www.Canada.ca or call Service Canada.

Duncan McLaren thanked Miriam for her very informative presentation. Miriam declined the honorarium stating that Government policy prohibits employees from accepting gifts of any kind.